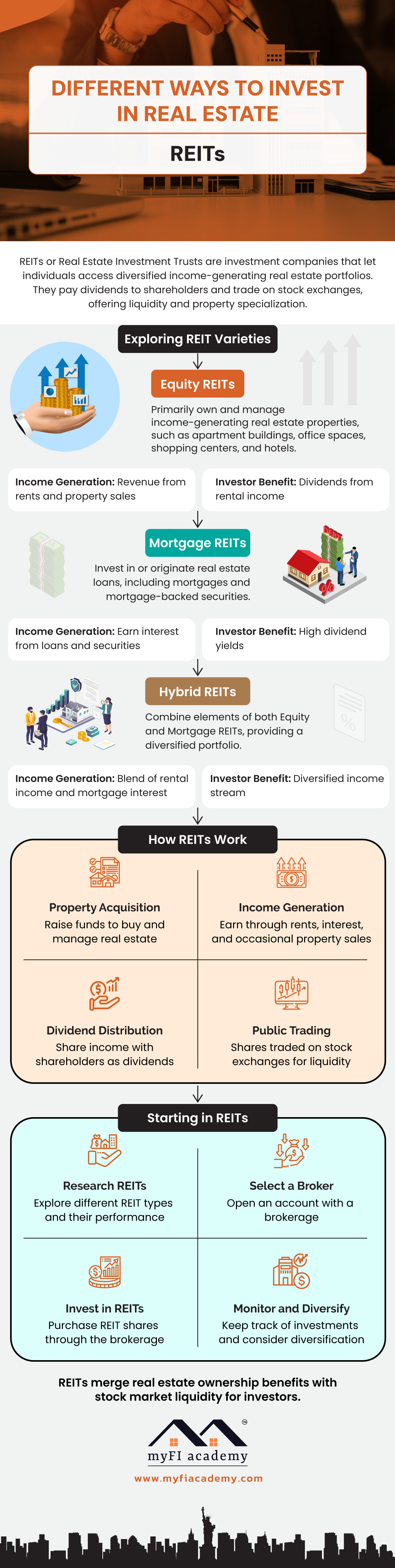

Uncover the nuances of Equity, Mortgage, and Hybrid REITs, each offering unique benefits and income streams. Explore how REITs function—from property acquisition to dividend distribution—and understand their integration of real estate ownership advantages with stock market liquidity. Gain practical insights on starting your REIT journey, from research and brokerage selection to investment and diversification.

Welcome to the next lesson.

REITs.

A Real Estate Investment Trust or REITs- R E I T is a specialized type of company that owns, operates, or finances income-generating real estate properties. REITs offer investors the opportunity to invest in real estate without directly owning physical properties. They are designed to provide a way for individuals to access real estate investments with relative ease, offering the potential for regular income and capital appreciation.

REITs own, manage, and maintain a wide range of real estate assets, including office buildings, apartment complexes, shopping centers, hotels, industrial properties, and more, just to name a few. These properties generate rental income, which is distributed to REIT shareholders in the form of dividends. So additionally, REITs can experience capital appreciation if the value of the properties in their holdings increase over time. Investing in REITs is relatively straightforward and accessible, making them a popular option for both individual and institutional investors. So here’s how someone essentially can invest in REITs.

Choose a type of REIT. There are different types, including equity REITs, mortgage REITs, hybrid REITs. Equity REITs own and operate properties, while mortgage REITs invest in real estate loans and mortgage-backed securities. Hybrid REITs combine elements of both equity and mortgage REITs. Investors should select the type of REITs that align with their investment goals and risk tolerance.

Next, you simply open an investment account. To invest in REITs. Individuals typically need to open an investment account with a brokerage firm or financial institution that offers access to REITs. Many brokerage platforms allow investors to purchase shares of publicly traded REITs, just like they would buy shares of common stocks as we covered in prior lessons.

Next, you want to research and choose a REIT. Once the investment account is set up, investors can research different REITs available on the market. Consider factors such as types of properties, the re-owns, geographical locations, historical performance, dividend yield, and management expertise. Then you purchase reshares after conducting your thorough research, you can purchase shares of the chosen route through your investment account.

Reshares can be bought and sold on stock exchanges, just like publicly traded securities. Then you’re going to want to monitor and manage just like any investment. It’s important to regularly monitor the performance of the chosen REITs. Pay attention to changes in property values, rental income, and market conditions that might impact REIT’s financial health and potential returns.

Next, you’re going to receive dividends. REITs are required by law to distribute a significant portion of their taxable income to shareholders as dividends. Investors can receive regular dividend payments, providing a potential source of passive income. But make sure you consider the tax implications. REIT dividends are taxed at ordinary income rates, but they may also be eligible for a 20% deduction for qualified dividends. As of the time of this recording in 2023. Definitely consult a tax professional to understand the specific tax implications of your REIT investments based on your financial picture. It’s important to note that while REITs provide diversification and professional management, they are still subject to market fluctuations and risks. Investors should carefully assess their investment goals, risk tolerance, and conduct thorough research before investing in any REITs.

And just like we covered in prior lessons, it is hypercritical to understand how the investment works, what the risks are, and compare that against your goals and what your risk tolerance is to determine if maybe REIT investing is right for you.

Read More