Learn to navigate the world of savings, understand interest rates, and make informed decisions about CDs. This course provides essential knowledge to optimize your savings strategy, fostering financial confidence and long-term stability.

Welcome to the next lesson.

Bank CDs, Savings Accounts.

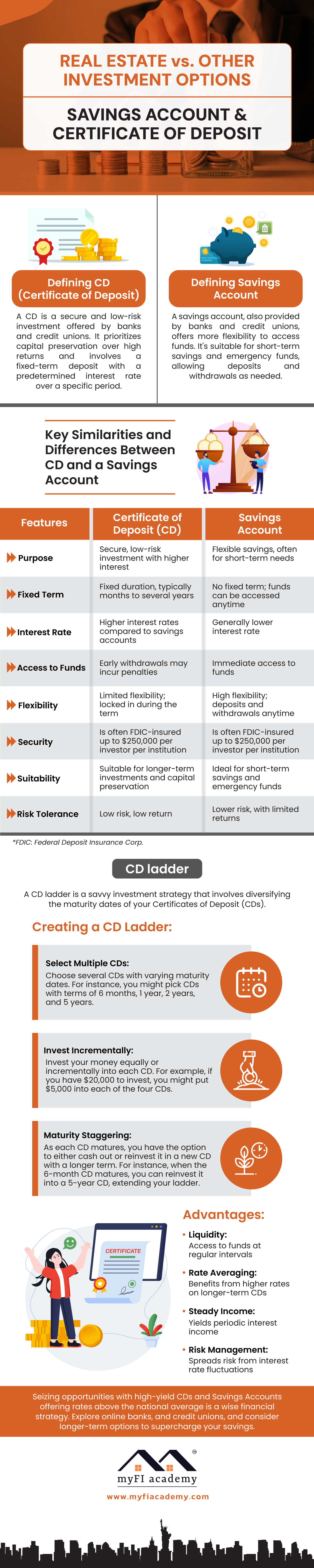

Anyone who’s made it this far in life has probably had a CD or a savings account at one point in their life. But just in case you can’t, or you need a refresher bank certificates of deposits or CDs and savings accounts are popular investment options for individuals seeking a secure and really low-risk way to grow their money. Both of these financial instruments are offered by banks and credit unions, providing individuals with a safe place to store their funds while earning interest. These options are particularly suitable for really risk-adverse investors who prioritize capital preservation over higher returns that come with greater market exposure.

So CDs are fixed-term investments that offer a predetermined interest rate over a specific period. When you invest in a CD, you agree to leave your money with the bank for the duration of the CD’s term, which can range from a few months to several years, depending on the CD and the bank you put it with.

In return, the bank pays you interest in your deposit. And this interest is often higher than what you would receive in a regular savings account. However, the trade-off is that you cannot access your funds before the CD matures without incurring an early withdrawal penalty. CDs are considered a safe investment due to the Federal Deposit Insurance Corporation or FDIC protection, which ensures deposits up to a certain limit, typically $250,000 per depositor per institution, but that could change and that could be specific depending on which bank or which lending institution you were purchasing CDs from. So definitely look into that at your particular bank.

Savings accounts on their hand provide more flexibility in terms of accessing your funds compared to CDs. These accounts allow you to deposit and withdraw money as needed, making them a convenient option for short-term savings goals and emergency funds. Savings accounts also earn interest, although the rates are generally lower than that of CDs. They’re ideal for individuals who want to keep their money readily accessible while still earning a small return. Over the past couple months, as of the time of this recording, the interest rate on savings accounts has been near zero. They have started to tick up slightly over the last couple of months, but anyone listening to this, who’s thinking back to the middle of the pandemic might be thinking savings accounts. There’s no way that’s an investment vehicle. It doesn’t earn any interest. That’s been the case for a long time, but now things are starting to change a little bit.

So like CD savings accounts are typically FDIC insured, offering an added layer of security, but again, double check with your financial institution to see what the limits are and also ensure that they are FDIC insured.

So to sum up both bank CDs and savings accounts offer secure ways to invest and save money while earning interest. CDs are best suited for individuals who can commit to leaving their money untouched for a predetermined period while savings accounts provide liquidity for those who need more frequent access to their funds. These options are particularly attractive for risk-averse investors who prioritize the safety of their principal amount and are really willing to forego higher return potentials associated with more volatile investment vehicles.

Read More