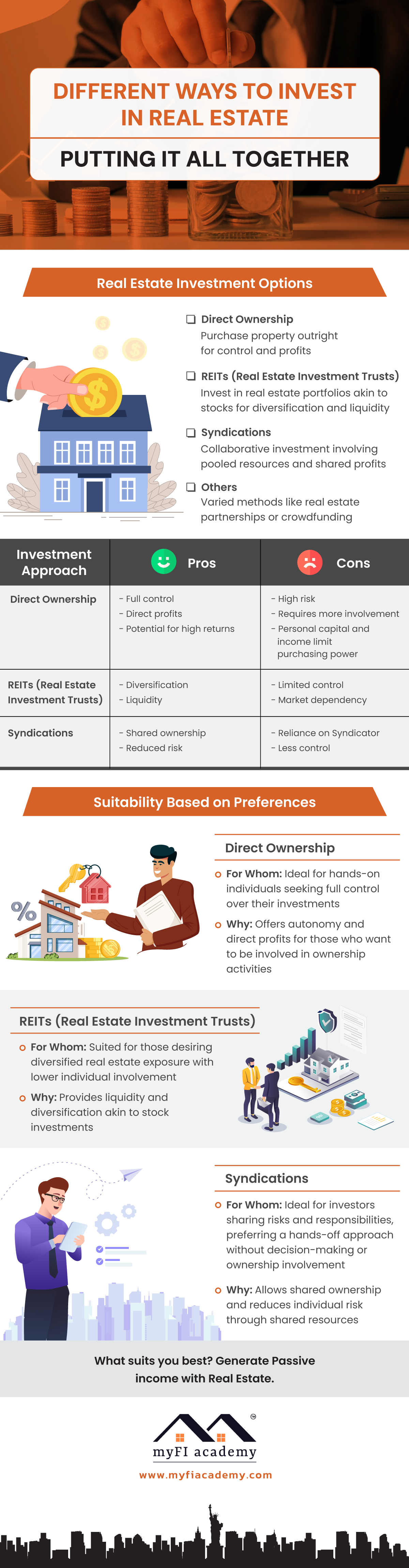

Explore investment options, including Direct Ownership, REITs, Syndications, and more, weighing the pros and cons of each. Uncover the ideal suitability based on individual preferences, guiding you toward generating passive income with real estate. Elevate your investment knowledge with myFI and discover the strategy that aligns best with your financial goals.

Welcome to the next lesson.

Putting it all together.

Investing in real estate can take various forms, including direct ownership, real estate investment trust or REITs, and real estate syndications. There’s also things out there that are like crowdfunded platforms, which at its core is really a syndication. You’re pulling your money with other people to purchase something larger than you might be able to do on your own. Each approach has its own set of benefits and owning real estate directly as an investment offers distinct advantages when compared to REITs and syndications.

So, first let’s talk about control and decision making. Direct ownership of real estate provides investors with a high degree of control and decision-making power over their properties. Investors can actively manage property operations, make strategic decisions on improvements or innovations, and choose tenants that align with their investment goals. This level of control allows investors to directly influence the property’s performance and value, potentially leading to higher returns, not necessarily, but potentially customization and diversification owning real estate directly enables investors to tailor their investments to their preferences and risk tolerances. They can choose specific properties, locations, and property types that align with their investment strategies. And this customization allows for greater diversification across different types of properties, reducing the impact of a single property’s performance on the overall investment portfolio.

So you have the potential for higher returns. Direct real estate ownership offers the potential for higher returns compared to investing or REITs in syndications, in my opinion. Property value appreciation, rental income and tax benefits can contribute to a strong return overall return on investment. Active management and hands on property improvements can further enhance the property’s income potential and overall value. Now, some of you listening might be thinking, Michael, I’ve invested in a syndication. They knocked it out of the park. They killed it. There’s no way I could come close to getting those returns for myself. And you could be right from my personal experience is what I’m sharing and educating everything contained within the academy. So based on my personal experience, I found that direct real estate ownership does provide the potential for the highest returns as compared to some of the other ownership styles out there.

Let’s talk about tax advantages really quickly. Direct real estate ownership comes with massive potential tax benefits, including deductions for mortgage interest, property taxes, and expenses related to property management and maintenance. These deductions can lead to sizable reduction in taxable income, ultimately lowering an investor’s tax liability.

Let’s talk about long-term wealth building. Owning real estate directly can be a powerful tool for long-term wealth building. As properties appreciate over time and rental income increases, investors can build equity and generate a steady stream of passive income. And real estate has a history of serving as a hedge against inflation, making it a super attractive asset for preserving and growing wealth. While direct ownership offers these advantages and others, it’s important to acknowledge the challenges that it entails. Direct investors must handle the property management, deal with tenant issues, and invest significant time and effort into property operations.

Additionally, the upfront capital required for direct ownership can be substantial when, as compared to a REIT or a syndication. So REITs on syndications on the other hand do offer a more passive approach to real estate investing. REITs provide exposure to a diversified portfolio of properties managed by professionals, and syndications pool investors funds to purchase larger properties that could be out of REIT for us as individuals.

So choosing the right approach really depends on an individual’s investment goals, risk tolerance, and level of involvement. Direct ownership, I would say, is suited for investors seeking hands-on control and the potential for higher returns, while REITs and syndications offer convenience and diversification with varying levels of involvement. A big, big, big, big difference between these three ownership types is leverage. And the ability to use leverage. When I say leverage, I’m talking about financing or a loan. If you go as a direct owner to a bank and say, I want to buy this rental property, it’s likely you have the ability to go get a loan for that. If you go to a bank and say, I want to invest in this person’s syndication, they might laugh at you. And so it’s something that is really important to be thinking about and cognizant of as you’re making the decision of where do I want to go spend money? As we mentioned previously, if you want to go spend a hundred grand on a REIT, you likely have to go have a hundred grand to invest in that REIT. If you want to go invest a hundred grand in a syndication, you got to have a hundred grand to go invest in that syndication. If you want to go invest in a hundred thousand dollar rental property, you might be able to get a bank to give you eighty grand and you’ve only got to come up with twenty.

So we’re going to be covering leverage in a future lesson, but just be aware of it that it’s often unavailable to us and to those investors who are looking to invest in recent syndications.

Read More