Uncover strategies to expand your real estate portfolio efficiently, maximize returns, and navigate challenges in a scalable manner. From property acquisition to management, this course equips you with the insights and tools needed to grow your real estate ventures successfully. Tune in to elevate your understanding of scalability and unlock new possibilities in the real estate market.

Hey, welcome to the next lesson on scalability.

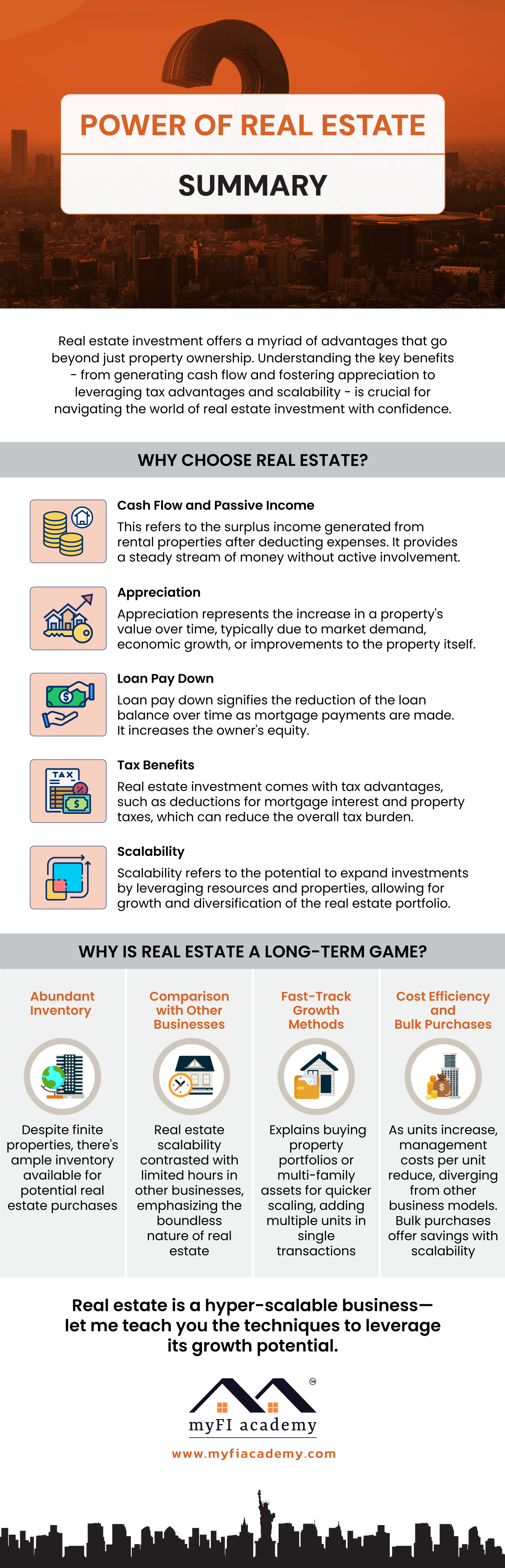

So one of the reasons real estate investing is attractive to so many people is because it is a very scalable business. Meaning it’s fairly straightforward, once you’ve started purchasing real estate to continue doing so, as long as you have the resources and assets needed to do so. While there are a finite number of properties in the world for all intents and purposes, there will always be enough inventory to go around. Now, anyone who tried to purchase real estate during the pandemic might say, well, Michael, that’s not always the case. But if we zoom out and look at real estate investing as a whole over the long term, there traditionally has been enough inventory to go around.

And when we compare this to other businesses like consulting, where you can only sell as many hours exist in a day, real estate is essentially boundless. And so if you have the inputs available, then the business continues to grow. So additionally, if you want to scale faster, you can simply either buy a portfolio of properties or look to purchase multifamily assets. Both are going to add multiple units to a portfolio with a single transaction.

Now we’ll get into the pros and cons of why an investor may choose to do this later, but just for now, know that it is possible to scale extremely rapidly with very few transactions. Again, as opposed to other businesses, if someone wants to scale really quickly, they might have to onboard new clients, new employees, and there might be a finite amount of resources available to you, which may make it more difficult to do.

So furthermore, as you scale, there are often significant economies of scale to be gained. Such as management fees and expenses and so, on a per-unit basis. The more units you have, often the cheaper your management should be, which is counterintuitive to many businesses. Also, as you scale, you’re likely going to be able to make bulk purchases for materials and possibly labor as well. So with size, often comes savings.

So again, just at a very high level, I want you to take away the fact that real estate is a hyper-scalable business. I’m going to teach you what you need to know, how to do it, and so you’re going to go fish for yourself once you learn how.

Read More